Cup Loan Program 2024: In the world of personal finance, there exists a variety of loan options designed to address the diverse needs of individuals. One such relatively lesser-known but beneficial financial product is the “Cup Loan.”

This comprehensive guide aims to gently explore the intricacies of cup loans, covering their definition, features, advantages, and important considerations. Whether you consider yourself an experienced borrower or are just stepping into the realm of personal finance, this article is crafted to provide you with gentle insights into the concept of cup loans.

Topics Cover Inside This Cup Loan Program Article

What is a Cup Loan?

A cup loan, commonly known as a “personalized microloan,” represents a short-term borrowing solution specifically crafted for minor financial needs. Unlike traditional bank loans, which often entail extensive paperwork and strict eligibility requirements, cup loans prioritize quick and straightforward access to credit for modest amounts.

The term “cup” in cup loans reflects the concept that borrowers can secure a loan equivalent to the cost of their daily cup of coffee. This makes it an apt choice for addressing immediate, small-scale financial needs.

Features of Cup Loan Program

- Modest Loan Amounts: Cup loans typically cater to small financial needs, ranging from a gentle $10 to a maximum of $500. The specific amount often depends on the lender’s policies and the borrower’s creditworthiness.

- Brief Repayment Period: Cup loans come with a short repayment tenure, usually spanning from a few days to a few months. This design allows borrowers to comfortably settle their loans promptly, preventing the accumulation of high-interest costs.

- User-Friendly Application: The application process for cup loans is known for its simplicity, offering a user-friendly experience that can be effortlessly completed online through the lender’s website or mobile app.

- Minimal Documentation: In contrast to the paperwork-heavy nature of traditional bank loans, cup loans often demand minimal documentation. This aspect ensures accessibility for individuals with limited paperwork or a modest credit history.

- Swift Fund Disbursement: Lenders prioritize the speedy disbursal of funds, with many offering instant approval and transferring the loan amount to the borrower’s account within a matter of hours.

- No Collateral Requirement: Cup loans are considered unsecured, eliminating the need for borrowers to pledge any collateral or assets to secure the loan. This feature adds an extra layer of ease for borrowers.

- Credit Score Flexibility: Cup loan lenders may embrace alternative credit scoring models, extending the availability of these loans to individuals with limited credit history or slightly lower credit scores. This flexibility ensures inclusivity in loan accessibility.

Document Required for Cup Loan

- Personal Information.

- Educational Background.

- Employment History.

- Skills and Qualifications.

- Statement of Purpose.

- References.

- Attachment of Documents.

Eligibility Cretaria for Taking Cup Loan

- Age above 18+.

- Stable source of income.

- Residing proof.

- Credit History and debt-to-income ratio.

How Does a Cup Loan Work?

Cup loans are commonly extended by online lenders, financial technology (fintech) firms, and microfinance institutions. The application process is designed for simplicity, requiring minimal documentation and incorporating a speedy approval mechanism.

When borrowers seek a loan within the specified cup loan range, the approved funds are typically swiftly disbursed directly into the borrower’s bank account—often within a matter of hours or even minutes. Additionally, the repayment terms are brief, usually spanning a few weeks or months. This short timeframe empowers borrowers to promptly settle the loan, steering clear of prolonged financial obligations.

Benefits of Cup Loans

- Emergency Financial Support: Cup loans serve as an excellent resource for managing unforeseen expenses or urgent financial situations that demand immediate attention.

- Effortless and Speedy: With a straightforward application process and prompt fund disbursement, cup loans offer a convenient solution for swiftly addressing pressing financial needs.

- Freedom from Long-Term Debt: The short repayment tenures associated with cup loans ensure that borrowers can quickly settle their debts without the burden of prolonged financial commitments.

- Inclusive Accessibility: Cup loans extend their financial assistance to individuals from diverse economic backgrounds, including those with limited credit history or lacking access to traditional banking services.

- Positive Credit Building: Timely repayment of cup loans has the potential to positively influence a borrower’s credit score, paving the way for access to more substantial loans in the future.

Step-by-step Guide How to Apply for Cup Loan Program in 2024

To apply for the Cup Loan Program, follow these simplified steps:

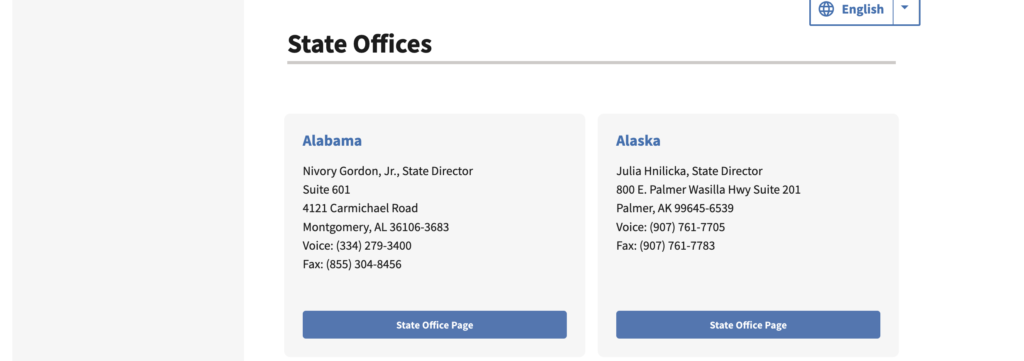

Contact Local USDA Rural Development Office:

- Visit the USDA Rural Development website to find the nearest office.

- Get guidance on your project’s eligibility and viability.

Prepare Application Package:

- Draft a statement of intent outlining your project details.

- Submit required documents, including architectural and engineering reports.

- Provide proof of financial viability and legal legitimacy.

Fill Out Forms:

- Complete essential forms such as RD 1940-1, RD 1942-46, RD 400-1, and others.

- Forms cover obligations, conditions, equal opportunity, assurance, certifications, and project details.

Submit Application Package:

- Use RD Apply, an online platform, or submit materials in person or by mail to your local USDA Rural Development office.

Wait for Approval:

- USDA Rural Development staff reviews your application for completeness and eligibility.

- Technical assessment of your project’s viability is conducted.

- Approval process duration varies based on project size and complexity.

Receive Loan Funds:

- Upon acceptance, receive a letter of conditions outlining loan terms.

- Fulfill outstanding tasks like acquiring licenses and insurance.

- Sign a promissory note and loan agreement.

- Access loan funds to commence your project.

Considerations Before Taking a Cup Loan in 2024

- Interest Considerations: While cup loans provide swift access to funds, their short-term nature might entail higher interest rates in comparison to conventional loans. Prospective borrowers should meticulously assess the interest charges before opting for a cup loan.

- Practicing Responsible Borrowing: Like any borrowing endeavor, it is crucial to borrow only what is genuinely necessary and within one’s capacity to repay. This precautionary measure helps prevent the potential pitfalls of falling into a debt cycle.

- Transparency and Legitimacy: Borrowers are advised to conduct thorough research and opt for reputable lenders, ensuring clear terms, fair practices, and ethical conduct throughout the borrowing process.

- Awareness of Hidden Fees: Some lenders may impose additional fees or charges, and borrowers should exercise diligence in understanding these potential costs before accepting a loan offer.

- Exploring Alternatives: Depending on the specific financial requirements, borrowers should consider exploring alternative options such as seeking support from family or friends, utilizing credit cards, or opting for traditional bank loans. These alternatives may present more favorable terms and interest rates for the borrower’s financial well-being.

FAQ’s Related to Cup Loan Program

How much amount will be provided under Cup Loan Program?

The amount you can borrow through the Cup Loan Program depends on your project cost and repayment capacity. The minimum loan is $10,000, with no specified maximum lending limit.

What is a Cup Loan Program?

A cup loan, or “personalized microloan,” offers a hassle-free, short-term solution for minor financial needs, emphasizing quick access without the paperwork of traditional bank loans. Borrowers can secure an amount akin to their daily coffee cost, making it ideal for immediate, small-scale financial requirements.

1 thought on “Cup Loan Program March 2024, Eligibility, Benefits, How to Apply Step-by-step Guide”