Atal Pension Yojana Scheme Details: Are you also considering your retirement pension, or who will care for your family if you die tomorrow? Who will take care of the money for that? So now you have to. There is no need to panic; our government has proposed giving you a pension under Atal Pension Yojana.

This scheme is for you only, so let us get detailed knowledge about it and who has what benefits for this. What is the eligibility, what are its benefits, how can you apply for it, and how can you avail yourself of the benefits of this pension scheme? I am Gaurav, telling you through the Sarkaribuzzer.com website, so let’s read this article. read completely

अंग्रेजी में नहीं पढ़ना चाहते हिंदी में पढ़ें अटल पेंशन योजना

Table of Contents

Key Benefits of Atal Pension Yojana Benefits

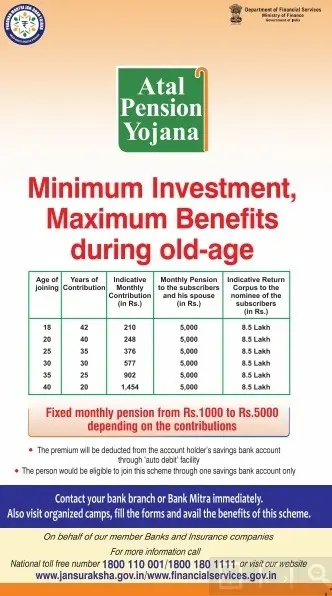

- You will get a lifetime minimum guaranteed pension of Rs 1000 to 5000.

- After your death, the pension amount will be received by his/her wife or husband.

- After the death of the wife or husband, the pension amount will be returned to the granddaughter until the age of 60.

Atal Pension Yojana Details Overview

| Scheme Name | Atal Pension Yojana Scheme |

| Launched by | Government of India |

| Beneficiary | All Indian Residents that have not paid tax |

| Amount | Rs. 5000 Per Month |

| Age limits | 18 – 40 Years |

| Atal Pension Yojana Scheme Official Website | https://www.npscra.nsdl.co.in/ |

| Start Date | 2015-2016 |

| Last Date | Always Open |

| Helpline number | (022) 2499 3499 |

Check out the Required Eligibility Criteria for Atal Pension Yojana Scheme Details

- This Atal Pension Yojana will apply to Indian citizens

- Aadhaar will be the main component of this scheme.

- If Aadhaar is not available at the time of account opening, it can be deposited later.

- All bank account holders can join this scheme.

Age Limit Required for Atal Pension Yojana Scheme

- 18 – 40 Years

Check out the Main Objective of the Atal Pension Yojana Scheme

The Government of India actively protects the working poor regarding old age income security and focuses on encouraging and enabling them to save for retirement.

In the Budget 2015-16, the Government of India introduced a new scheme named ‘Atal Pension Yojana‘ (APY).

Also Read PM Modi Scholarship Scheme

The Atal pension yojana scheme is for all citizens working in the unorganized sector and is managed by the Pension Fund Regulatory and Development Authority (PFRDA) through the NPS structure.

Required Documents for Applying Atal Pension Yojana Scheme

- Aadhar Card: Aadhar Card for your identity.

- Address Certificate: Certificate

- Bank Details: Bank details to receive cash or open a new bank account.

- Mobile Number: Mobile number for contact.

- Passport-size photo: Passport-size photo, etc., as required.

Default fee:

Banks are required to collect additional amount for delayed payments, with the amount varying from a minimum of Rs 1 per month to Rs 10 per month:

- Rs 1 per month for contributions up to Rs 100 per month.

- Rs 2 per month for contributions between Rs 101 and Rs 500.

- Rs 5 per month for contributions between Rs 501 to Rs 1000.

- Rs 10 per month for contributions above Rs 1001 per month.

The fixed amount of interest/penalty will form part of the subscriber’s pension corpus.

Step-by-Step Guide for Applying Atal Pension Yojana Scheme

There are two ways to apply for the Atal pension yojana: online mode and offline mode. I will guide you through both steps. Just follow the simple steps given below.

Steps to apply online for Atal Pension Yojana

- You can apply online at any bank. Here we are giving you the example of the Bank of Baroda. Because the Bank of Baroda website is open, you must go to the Bank of Baroda website.

- The link will be given to you below if you click on the link,

- A form will open in front of you on which it is written how to apply online, Atal Pension Yojana.

- As soon as you come to it, you must fill in your name here, and an email ID will be created.

- You will have to fill the mobile number,

- You will have to select your state.

- And select your city, that is, whatever district or whatever is your state and whatever is your city, you select all those things,

- After that, you have to select the branch.

- It will be of Bank of Baroda, and after that, you will enter the PIN code, whatever captcha code is written in it, and click on submit.

- You will get a message from the bank as soon as you click submit.

- Or the call will come, and as soon as you get the basic call, you will have to develop it in the bank, and then they will take further action through the offline form.

If you want to see the offline form method, see the next paragraph, in which we mention the offline form. The form has also been shown, and you don’t need to do it through the Bank of Baroda only; you can do it through any bank but online. We have the link to the Bank of Baroda only; we have given you the online form for the Bank of Baroda.

Steps to apply for Atal Pension Yojana Scheme offline mode

- On the official website, navigate to the download section.

- Choose the language preference for the offline form (English, Hindi, or other regional languages).

- Download the PDF of the offline form.

- Open the downloaded form and fill in the required details:

- Personal details (name, date of birth, email ID, phone number)

- Bank details

- Spouse details (name, Aadhar card number)

- employment details

- Country, state, and city details

- After completing the form, submit it to the selected bank branch.

- Note: The offline form is available in various languages, such as Marathi, Bengali, Tamil, etc. Ensure all necessary details are accurately filled out before submission at the bank.

Indicative monthly subscription fee for Atal Pension Yojana Scheme

| आयु (वर्ष) | मासिक पेंशन राशि (रु.) | सांकेतिक मासिक अंशदान राशि (रु.) |

|---|---|---|

| 18 | 1000 | 42 |

| 20 | 2000 | 84 |

| 25 | 3000 | 126 |

| 30 | 4000 | 168 |

| 35 | 5000 | 210 |

| 40 | – | – |

| 40 | 291 | – |

| 45 | 582 | – |

| 50 | 873 | – |

| 55 | 1164 | – |

| 60 | 1454 | – |

Important Links For Atal Pension Yojana Scheme Details

| Important Links | |

| Online Registration Link | Click Here |

| Atal Pension Yojana Scheme Details Pdf Notification English | Click Here |

| Atal Pension Yojana Scheme Details Pdf Notification Hindi | Click Here |

| Official Website | Click Here |

My Advice Pro Tips Free

So, if I talk about my pro tips here, I talk about my advice here; I am Gaurav, as you know from the sarkaribuzzer.com website.

If you want your future to be prosperous, you should not be tense. You don’t have to worry about any accident happening to you tomorrow, or if you want everything for your old age, then you should apply for this scheme because this pension scheme is very good.

For you people, so that your future can be secured, one of its benefits is that if something happens to you tomorrow, then your family members will not have to worry immediately.

You will benefit from a pension right from your home, so I am saying this. I would say that you should apply for this scheme as soon as possible. If you face any problem applying this scheme on time or need any help, you can contact us. Contact details will be given to you. Will be found below

Conclusion

Talking about the conclusion, an Atal Pension Yojana scheme has been run by the Government of India for you. If you fall in the poverty category and are also thinking about the future, and I too should get a pension sitting at home, then you can avail of this scheme. You can apply for the scheme;

if under this scheme you will be getting a pension of ₹ 5000 every month sitting at home, then apply for it, and if something happens to you tomorrow, then your family members will benefit from this pension.

For example, if your wife becomes your husband or your husband and wife also expires tomorrow. All of your granddaughters and grandchildren will continue to get the benefits of this scheme, so apply for it. This is for you guys.

FAQs Related to Atal Pension Yojana

What is the atal pension yojana?

Atal Pension Yojana is a scheme for every Indian who wants a pension after 60. Year read more details inside the article.

What is the Atal pension Yojana scheme?

The Atal Pension Yojana Scheme is for every Indian who wants a pension after 60. Year read more details inside the article.

How do you check the Atal pension yojana balance?

Just visit the bank and check your balance.

How to close the atal pension yojana?

Go to the nearest bank and submit a close form to close your atal pension Yojana account.

Who is not eligible for the atal pension yojana?

Those Indian Citizens who have paid income tax are not eligible for Atal Pension Yojana.

How do you download the Atal pension yojana statement?

Go to the nearest bank and get your bank statement.

How to apply for atal pension Yojana

There are two ways to apply for Atal Pension Yojana online and offline; check out this article. I have explained them in detail.

How do you cancel the atal pension yojana?

Go to the nearest bank and submit a close form to close your atal pension Yojana account.

5 thoughts on “Atal Pension Yojana Scheme Details 2024, Eligibility, Benefits, Step-by-Step Guide How to Apply”